Memorials: Thomas M. Doerflinger (1952–2015)

My earliest recollection of Tom was his announcement that he had no interest in an academic career and that he intended to work “on the street.” After conjuring up various lurid possibilities, I gradually realized that he meant Wall Street. A rather unusual career path, I thought, but for Tom it made perfect sense. He had little inclination to be a teacher. After studying Philadelphia merchants in the late eighteenth century, he intended to put his insights to use in analyzing market behavior in the late twentieth century. He also once told me that he aimed to make his fortune as a Wall Street analyst and then retire to being a full-time historian once again. He was in the process of doing just that, when unfortunately he died suddenly from a stroke on August 23, 2015.

Tom was an unusual individual who liked to surprise. Part of that, I think, owed to his rather exotic family background. Tom was born in Rome to parents who had children from previous marriages and were in their mid-forties, so he was something of a “miracle baby.” His father was a well-known amateur folklorist, who published what is probably still the standard collection of American sea shanties; he was also an amateur magician who wrote a book about the subject. His mother was a successful and prolific short story writer for women’s magazines. Her mother, Tom’s maternal grandmother, was Louise Homer, the principal contralto at the Metropolitan Opera for several decades and a world-famous star. His uncle, Sidney Homer, founded the bond research department at Salomon Brothers investment bank, and wrote a book about the history of interest rates. Tom never boasted of such connections; rather, he had a shy, self-deprecating demeanor, although not lacking in self-assurance. One adjoining office mate recalled that Tom never seemed to pause when he arrived each morning for work. He would stride into his office, close his door, and in an instant be typing. No writer’s block for Tom. He once took a three-day “holiday” from his own work to type out all his notes on seafaring labor that he had culled from merchant records in Philadelphia. He forwarded them to Marcus Rediker. Given that he and Marcus frame the field ideologically, this was an extraordinary gesture. The day he turned in his book manuscript to the Institute of Early American History and Culture, I found him shredding his research notes. “No need for them anymore,” he declared matter-of-factly. Tom was a quirky, independent-minded, seemingly unsentimental person, although Danny Vickers, another research fellow at the Institute, recalls Tom waking in the middle of the night from a dream about turtles crossing the Colonial Parkway. Tom rushed across town in the dark to discover turtles traversing the road and carried them to safety. He once took great delight in acting as informal tour guide at the Bronx Zoo, when I, my wife, and young son visited him. He in turn had a happy family life, and is survived by Janet, his wife of thirty-four years, and their twenty-four-year-old daughter Jane.

Tom was a born historian. While still in high school, he wrote his first article, “Hibernia Furnace during the Revolution,” which was published in his native state’s historical journal. It was the first of three articles he published on the early American iron industry, the last of which appeared in the William and Mary Quarterly. While an undergraduate at Princeton (he graduated in 1974), he wrote “The Antilles Trade of the Old Regime: A Statistical Overview,” which the Journal of Interdisciplinary History published in 1976. It was an early demonstration of his ability to analyze statistical series and compare the development of individual ports: Nantes, Rouen, Bourdeaux, and Marseille. At Princeton, he singled out the teaching of Robert Darnton, James Banner, Jr., and the late Wesley Frank Craven as particularly influential. By the mid-1970s he was a graduate student at Harvard University where he worked under what Tom described as the “incisive counsel” of Bernard Bailyn. In 1978–79 Tom benefited from a year as Andrew W. Mellon Fellow at the Philadelphia Center for Early American Studies, which had just opened its doors, under the direction of Richard Dunn. He then returned to Harvard, where he obtained his Ph.D. in 1980. That year, Tom was particularly proud to win one of Harvard’s Bowdoin Prizes, awarded for an essay of originality and high literary merit, and join former winners and luminaries such as Ralph Waldo Emerson, Henry Adams, Arthur M. Schlesinger, Jr., John Updike, and current Chief Justice John Roberts. In fall 1980 he arrived as a research fellow at the Institute of Early American History and Culture. After that two-year stint, which he described as offering “a superb environment for turning the dissertation into a book,” he stayed around for a year to assist the Institute as Visiting Editor of Book Publications. He particularly enjoyed editing Fred Anderson’s first book, since they were old classmates.

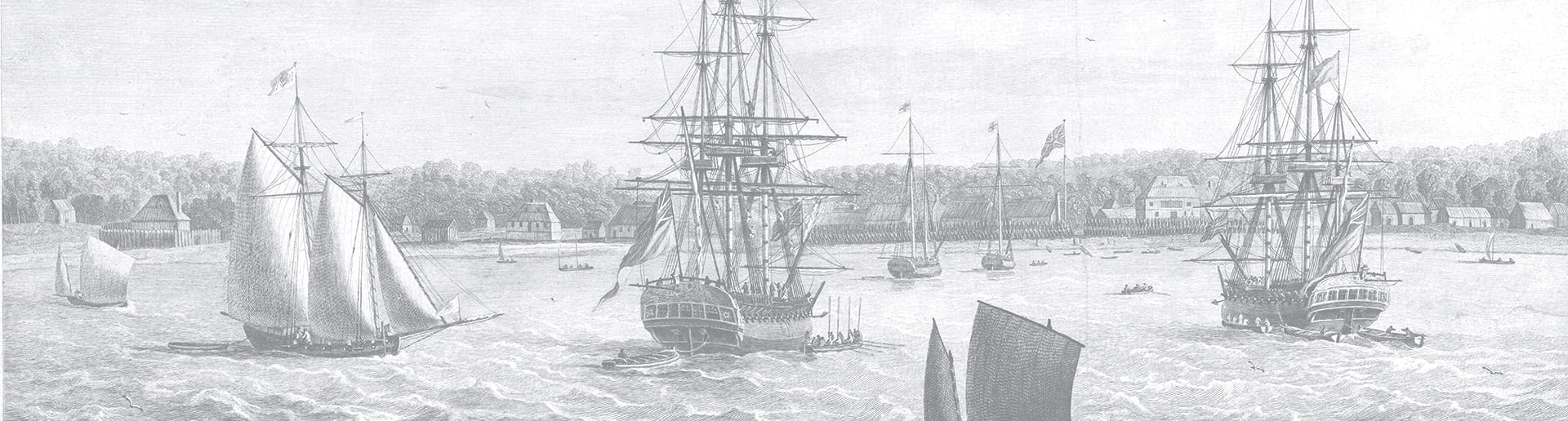

His own book, A Vigorous Spirit of Enterprise: Merchants and Economic Development in Revolutionary Philadelphia appeared under Institute auspices in 1986. The central question he set out to explore was why certain places and peoples achieve superior economic performance. He was sure that a comprehensive approach was necessary, because “economic development is, at bottom, not merely a physical achievement but a cultural expression, and a social process, a distinctive manifestation of the values of a people.” His study explains how the many risks, the “fabric of adversity” confronting American merchants, created an aggressive entrepreneurial culture that propelled economic growth. It ended by arguing that the key characteristics of northern businessmen—“flexibility, innovativeness, and speculative drive”—were “not much in evidence on the great southern plantations.” Thirty years later, the book remains the standard picture of the Philadelphia merchant community in the age of the American Revolution. It won the Bancroft Prize and the American Historical Association’s Herbert Feis Award for Nonacademically Affiliated Historians.

When his book was published, Tom was well ensconced on Wall Street. In 1983 he went to work at PaineWebber where he coauthored a book (with Jack Rivkin) about how entrepreneurs in six industries, ranging from the railroads to biotech, secured their start-up capital. Published by Random House, Risk and Reward: Venture Capital and the Making of America’s Great Industries, appeared in 1987. Tom spent about twenty-five years on Wall Street as a senior equity strategist, first at PaineWebber and then UBS Financial Services, providing, for example, monthly forecasts of S&P 500 profits. He was especially proud that, during the three years he chaired a committee managing one of UBS’s investment portfolios (a virtual portfolio—for demonstration purposes), it significantly outperformed the S&P 500. With his priorities elsewhere, his work on early America waned. He did manage, however, to publish an essay on farmers in the Philadelphia market area in 1988 and an article on labor recruitment and deployment in an ironworks in 2002. One notable act of philanthropy was his offer of Doerflinger fellowships, which enabled scholars to study business history for a year with few strings attached.

Perhaps Tom best described himself in his blog, http://www.wallstreetandkstreet.com, as “a prominent observer of American capitalism—past, present and future.” He was an enthusiast, but a candid one. Danny Vickers’s term for Tom was “basically a straight arrow,” which sums him up well. Many of his friends disagreed with his politics, but they knew they were in the company of a superior scholar, a searching thinker, a writer of great clarity and verve, a person of wry humor, and above all a man of great decency, humility, and integrity. As it happens, his article, “Capital Generation in the New Nation: How Stephen Girard Made His First $735,872” graces the October 2015 issue of the William and Mary Quarterly. It is a pity that Tom was not able to add more such pieces, but this single essay is a powerful testament to his abilities and generosity to fellow scholars—as well as wit.

Philip Morgan

Johns Hopkins University